SMM News on June 17:

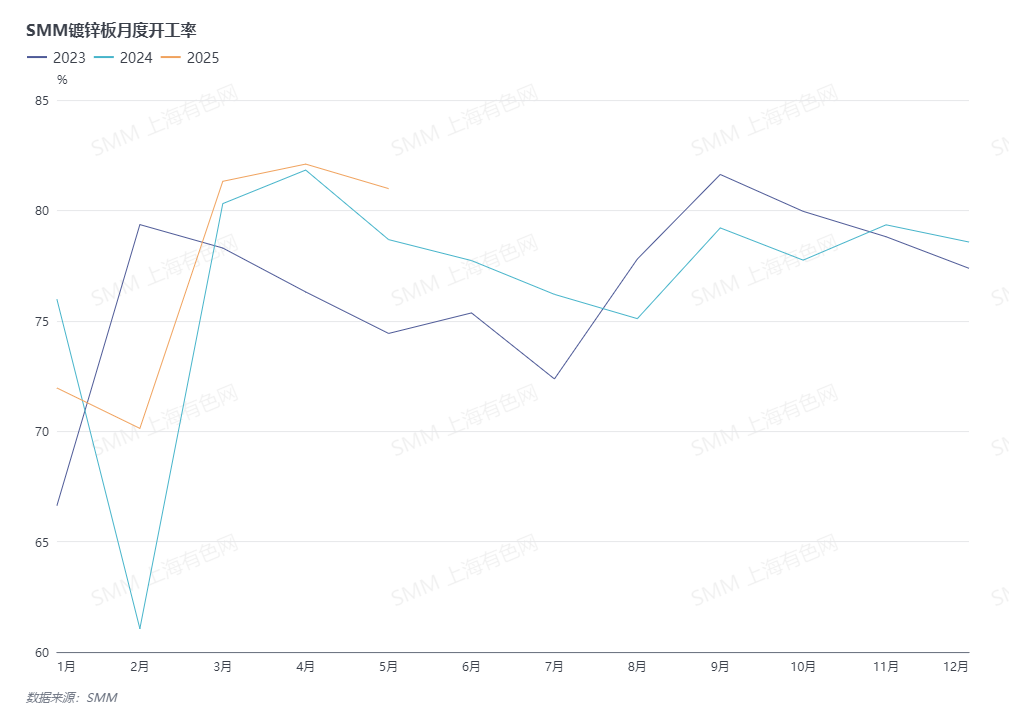

As Q2 draws to a close, SMM has learned that the operating rate of domestic galvanized sheet production in May declined by 1.1% MoM. With the arrival of the off-season, how is the market sentiment for June? Can the relevant production levels be sustained?

Let's look at domestic trade orders.

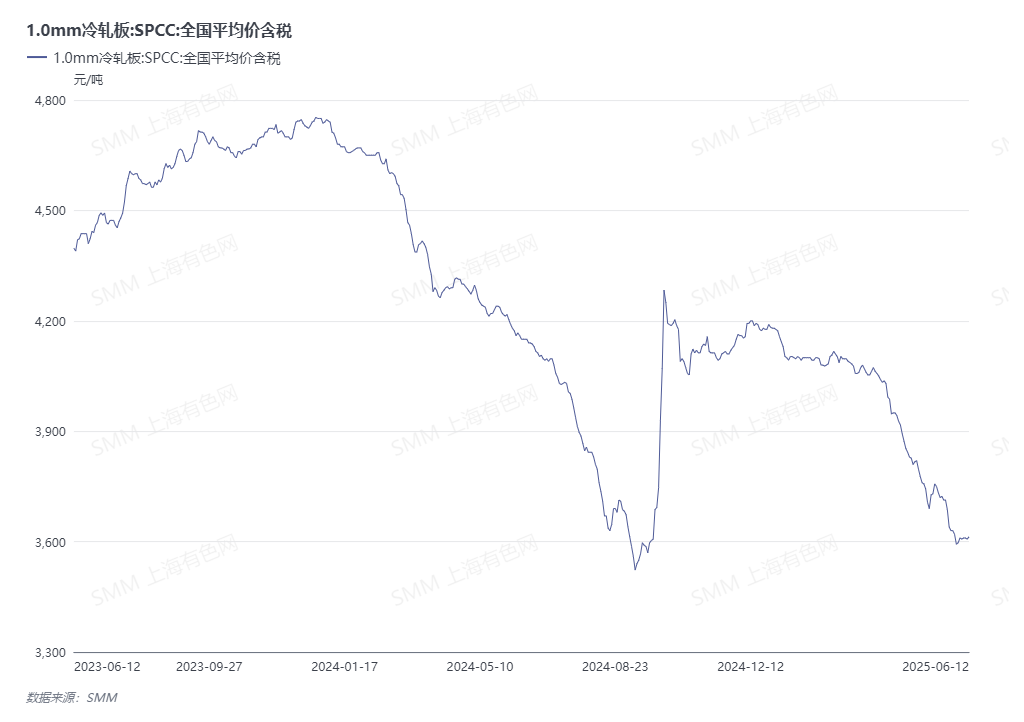

- As ferrous metals prices continue to decline, the market sentiment remains cautious amid the "rush to buy amid continuous price rise and hold back amid price downturn" psychology. Terminal orders for galvanized sheet plants have largely remained at basic demand levels, compressing corporate profits to some extent. Additionally, with the weakening of end-use demand in May, domestic trade orders for some enterprises also declined, leading to a reduction in production.

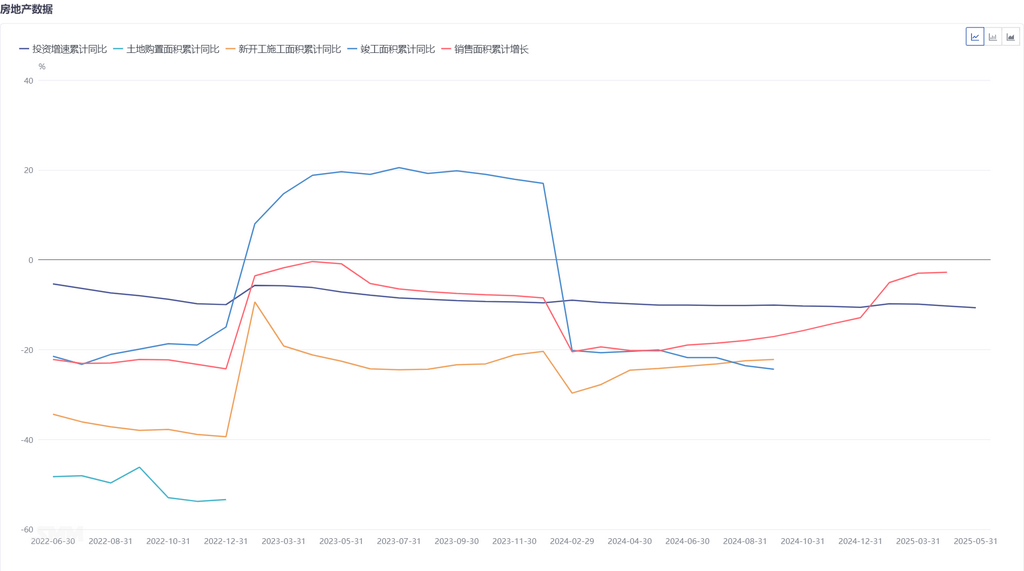

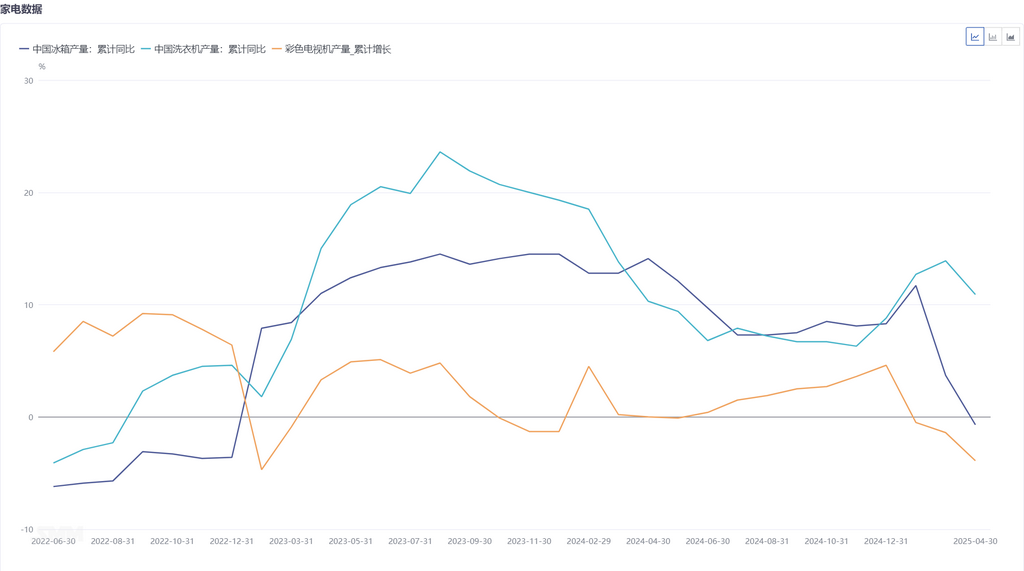

- Entering June, the plum rain season in south China has arrived, affecting outdoor construction activities. Consequently, orders for construction sheets have seasonally deteriorated. Summer sales promotions and inventory preparations for home appliance plants have also been completed, with orders showing mediocre performance. Although automotive sheets are supported by NEV orders, there has been no significant MoM increase. Overall, domestic trade orders are expected to continue decreasing compared to May.

Now, let's examine export orders.

SMM has learned that since April, when China began strictly investigating export orders purchased through fake invoices, overall export orders have been somewhat affected. Furthermore, despite a significant reduction in tariff rates after the Sino-US negotiations in mid-May, the market remains concerned about potential tariff fluctuations. Additionally, the "rush to export" orders in the early stage have led to the early release of future demand, and a new round of "rush to export" has not emerged. As previous export orders are gradually fulfilled, orders received by some export enterprises in May have weakened MoM. Coupled with seasonal impacts, new export orders received in June have also been mediocre. Some export enterprises have chosen to increase their domestic trade proportion to maintain their production levels.

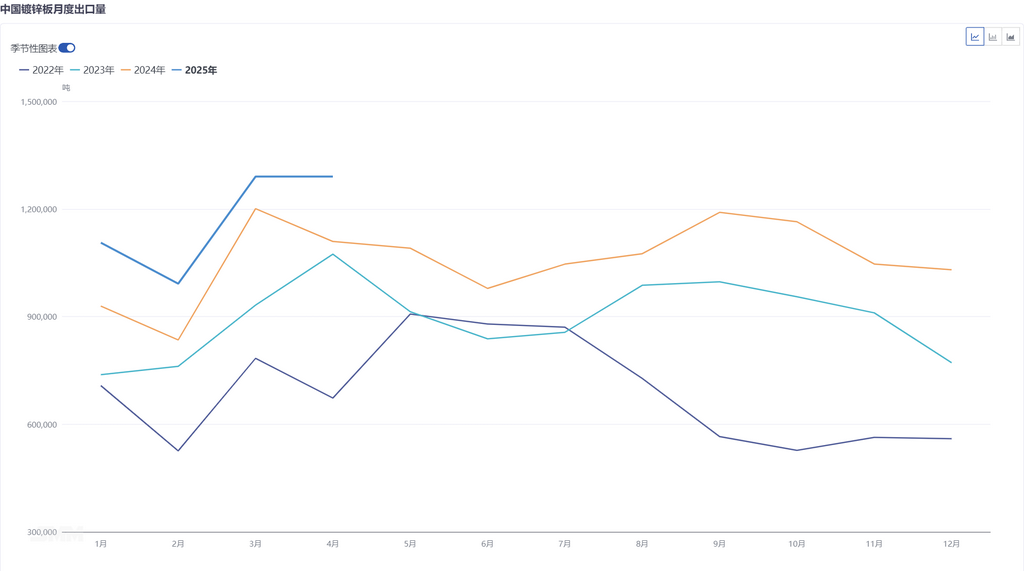

In summary, from the perspective of galvanized sheet orders, both domestic trade and export orders have declined MoM in June's off-season. Amid price wars, the market continues to experience cut-throat competition, and ferrous metals prices have not shown any improvement. It is expected that the production levels of relevant sectors will continue to deteriorate compared to May. SMM will continue to monitor the subsequent export performance of galvanized sheets.